Mantic Monday: Judgment Day

...

Judgment Day

A red sun dawns over San Francisco. Juxtaposed against clouds and sea, it forms a patriotic tableau: blood red, deathly white, and the blue of the void. As its first rays touch the city, the frantic traffic slows to a crawl; even the birds cease to sing. It is Election Day in the United States.

Future generations will number American elections among history's greatest and most terrible spectacles. As we remember the Games in the Colosseum, or the bloody knives of Tenochtitlan, so they will remember us. That which other ages would relegate to a tasteful coronation or mercifully quick coup, we extend into an eighteen-month festival of madness.

The mathematicians say there are simple voting systems that could practically ensure the selection of a universally-popular moderate. We reject these, and - in a country with a hundred living Nobel laureates - near-invariably pick a pair of mediocrities, extremists, or lunatics. Once their inherent badness has been magnified by a froth of propaganda, millions end out convinced that one candidate or the other wants to hunt them for sport, put them in camps, or institute a communist/fascist/theocratic dictatorship. Some people threaten to flee the country if the wrong person wins; others prepare to commit suicide. Loving grandmothers disown their family members for being too tepid in their loathing. Psychologists warn of an upcoming wave of mass trauma.

The nation’s smartest forecasters and statisticians labor full-time to mark microdeviations in the odds. Bettors sink $2.2 billion dollars - enough money to buy every homeless person in America a used car - into prediction markets. I reload Nate Silver’s blog dozens of times a day, half-anxious-for, half-dreading the next update. Any pollster capable of giving us a novel word of reassurance briefly becomes an ultra-megacelebrity before collapsing back into obscurity.

Yet in the end, everything is so perfectly balanced that the sum total of these luminaries refuse to say which side of even we’re on. The nation balances on a knife’s edge. Eli Lilly stock moons.

A red sun hangs over Philadelphia, where American democracy began and may yet end. A man walks into a diner just before closing time. He looks like a good tipper. The waitress was hoping to leave early and go vote. She decides against. Seven trumpets sound; seven seals are opened; there is silence in Heaven for the space of about half an hour.

As George RR Martin put it, “God flips a coin and the world holds its breath.”

Tomorrow - if we are so lucky - there will be a result. The great function that has consumed us for so long will return 0 or 1. The pundits who guessed 51-49 will be hailed as prophets; the pundits who guessed 49-51 will get bullied out of public life. The winner’s campaign operatives will be praised as world-historic geniuses, the loser’s mocked forever as utter nincompoops. Thousands of lifelong public servants who backed Mr. 49% will be tossed from DC like used toilet paper and replaced with thousands of hacks who backed Mr. 51%. Funding streams will go dry. Whole lands will turn to economic deserts. Fortunes will be destroyed. A few people will make good on their exile and suicide threats. Most won’t. The Union will either survive or not. If it survives, we’ll do it all over again four years later.

A red sun sets over DC. The marble monuments are stained crimson; the statues of Lincoln and Jefferson and the rest look like they writhe in hellfire. The people seclude themselves in their houses. A city where even the Christians are atheist kneels in prayer.

On some level, they know - we know - it was never just about choosing a leader. It was all for this - the same urge that drove the games of the Colosseum and sacrifices of Tenochtitlan. The need for a single moment of unconditioned reality. For one evening, the people of the richest and most secure nation in history, fat off the spoils of six continents, will know the same fear as the starving Catalhuyuk farmer, staring at the sky, wondering if the rains will come. For one evening, everyone - rich or poor, religious or secular, Democrat or Republican - will join in the prayer of the poet:

“Judge of the Nations, spare us yet

Lest we forget - lest we forget!”

Don’t Blame Me, I Voted For Kodos

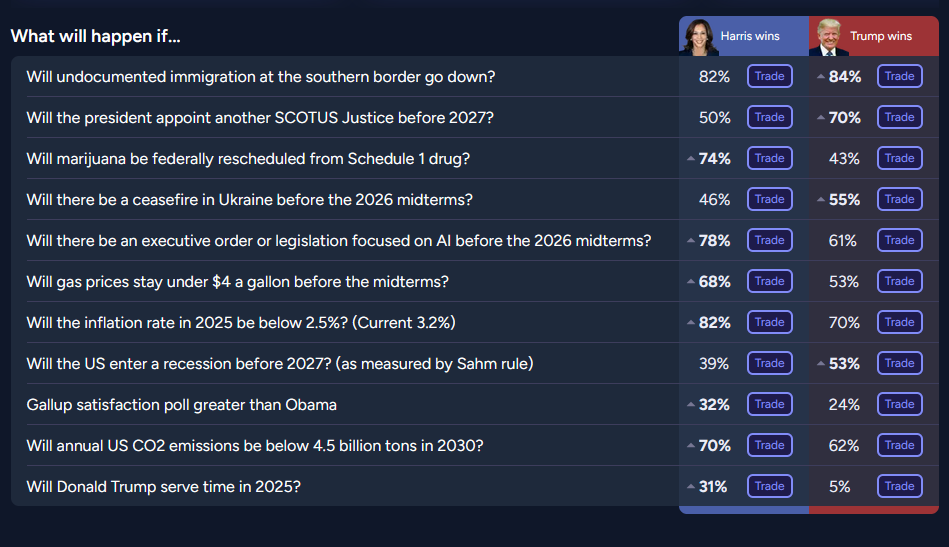

Metaculus uses experimental “conditional forecasts” to determine the consequences of a Trump/Harris victory.

How it works (example): you set up two forecasts:

If Trump wins, will China invade Taiwan?

If Harris wins, will China invade Taiwan?

When happenstance invalidates one of them (eg Harris wins, and your “if Trump wins…” market becomes meaningless), you close it without resolution and nobody gets money / reputation / meaningless forecasting points.

Here’s what they’ve got:

They could have picked better questions (I’m not sure why “Trump in power beyond 2028” needs to be conditional), but some of these are interesting:

China more likely to invade Taiwan under Trump (25%) than Harris (17%), and Harris is more likely to fight back (75%) than Trump (54%).

Russian prospects in Ukraine better under Trump (75%) than Harris (40%)

Iranian nukes more likely under Trump (49.5%) than Harris (45%)

All of these involve foreign policy going worse under Trump than Harris. Is this unfair?

Even Trump’s supporters would agree he is less interested in funding Ukrainian resistance than Harris; Metaculus’ numbers here seem in line with this.

Harris is more likely to continue deals where Iran gets sanctions relief / money in exchange for not going nuclear. Whether or not you agree with Trump that those deals are extortionary and unfair, it makes sense that Iran is more likely to go nuclear if those deals are discontinued. But this is also a small effect and could be noise.

The Taiwan numbers are the least convincing, but seem to be based off of arguments like the ones here: Trump has said that Taiwan should “pay for” defense, and generally been skeptical of foreign entanglements.

And here’s Manifold’s version of the same thing:

Polymarket’s Wild Ride

On October 14th, Polymarket gave Donald Trump 54% odds of winning, compared to Nate Silver’s 49% and Metaculus’ 45%. Whatever, everyone knows Polymarket has a small right-wing bias, and 5% isn’t too bad.

Three days later, it had risen from 54% to 61%, despite no news and no change for Metaculus or Nate, bringing the Polymarket/Silver spread to an unprecedented 11%.

What happened? This is the rare prediction market story where the answers are already in the New York Times and the Wall Street Journal: one really rich guy put $30 million on Trump (a recent followup by Jorge Velez claims it’s actually more like $75 million). Although he prefers to remain anonymous, reporters have talked to him and are able to reveal that he’s French, goes by “Theo”, is a former banker, and has no insider connections. He just a normal rich guy who really thinks Trump will win.

This is exactly the sort of shock that prediction markets are supposed to be resilient against. Instead, the market stayed at 61% for days, swung even higher for a while, finally fell back down two weeks later, then went back up again. What happened?

The simplest story would be insufficient liquidity: there just weren’t enough people to gather the $75 million it would take to bet against Theo. This is superficially plausible: Polymarket requires crypto and bans Americans, so the mispricing couldn’t be corrected until enough crypto-literate, American-election-following foreigners showed up to bet $75 million. That’s a tall order, and maybe it took two weeks.

But the simple story seems wrong. Other real-money markets rose approximately in tandem with Polymarket. For example, Smarkets got to Trump 59% on 10/16, and peaked at 64% on 10/30. Kalshi followed a similar path. Both tracked Polymarket, not Nate Silver or Metaculus (neither of whom ever went above Trump 55% since Harris joined the race).

So I think the remaining stories are:

Theo made his giant bet on Polymarket. By coincidence, at the same time, bettors everywhere massively overcounted a few good polls for Trump and started a feeding frenzy on pro-Trump shares. This made all other markets gain, and Polymarket stay at its Theo-caused peak, until a few bad polls for Trump brought everyone back to reality last week.

Theo made his giant bet on Polymarket. Everyone else arbitraged the wrong direction, maybe (falsely) thinking that Theo had secret knowledge. Even when the news articles came out saying that he was just some guy, people didn’t believe them, and stuck with the secret knowledge explanation.

Theo made his giant bet on Polymarket. Everyone else did some kind of galaxy-brained meme stock herding behavior. Maybe bettors, both on Polymarket and Smarkets, thought that Theo might make other big bets, or that other people would falsely expect this, or that other people would get excited and follow the vibes - and they hoped to profit off of those people and sell before the election.

[EDIT, thanks to commenter Chastity for the explanation] There wasn’t enough liquidity to get Polymarket back down, but traders looking for free money arbitraged with Polymarket-Kamala plus Smarkets/Kalshi-Trump. Polymarket is so much bigger than the other two (and Theo kept driving it back up), so this just looked like Smarkets and Kalshi going all the way up to Polymarket levels.

None of these make prediction markets look very good.

I’ll go further: this is the maximum disaster scenario for prediction markets that all of their opponents warned about and that I mostly dismissed. Someone manipulates a market (in this case non-maliciously) just before an election, the market fails to correct, and it significantly changes people’s perceptions, maybe in a way that could play into spurious election challenges later (“Polymarket said there was a 66% chance he would win, but he lost, so it must have been rigged!”) You laugh, but I’ve seen the Twitter discourse and it’s not pretty:

I think we’ve stepped back from the absolute most apocalyptic scenario: Polymarket is back down to 58% Trump - only eight points above Nate Silver - and WSJ has revealed Theo to be an ordinary degenerate gambler rather than a sinister manipulator. Still, this serves as a challenge to prediction market fans to figure out what went wrong and whether it will happen again.

It also serves as yet another point in favor of non-real-money forecasts like Metaculus, Nate Silver, and Manifold, all three of which agreed with each other while disagreeing with the big real-money markets like Polymarket, Smarkets, and Betfair. In theory we can’t say which group (real money vs. no money) was right. In practice, we know that Polymarket was mostly skewed by one giant bet, that there wasn’t nearly enough pro-Trump news to explain the movement, and that past disagreements have usually resolved in favor of the no-money markets. I’m as surprised as anyone to learn this (especially since Manifold is so close to a money market that a lot of explanations for real-money markets’ failure ought to affect them too), but it does seem to be a consistent feature of these things.

(sometimes when people claim prediction markets are wrong, commenters harangue them with “well, did you bet in them?” It’s illegal to bet on Polymarket in the US, and if I secretly did an illegal thing, I wouldn’t admit it, sorry.)

Kalshi Plays The Long Game

The CFTC has suffered a string of recent defeats in its quest to regulate prediction markets. Most recently, with one month to go, an appeals court struck down their decision that Kalshi couldn’t offer election betting. In their ruling, the judges said that:

While the question on the merits is close and difficult, the Commission cannot obtain a stay at this time because it has not demonstrated that it or the public will be irreparably harmed while its appeal is heard.

I think this means the CFTC had a very high burden of proof, because they were trying to get Kalshi to stop trading right away before the election, and they failed to meet this burden by providing anything more than the usual vague case that someone might manipulate the market - but I’m not an expert, you should read the full ruling here.

So now Kalshi has election markets, and…

…they followed the same (probably false) pattern as all the other real-money markets like Polymarket, Smarkets, etc. Oh well.

This Month In The Markets

The market defines “major” as five hundred participants causing either $1 million in damage or 10 hospitalizations/deaths. This market is priced higher than Manifold’s chance that Trump loses, suggesting a ~5% chance that the Democrats riot (or that Republicans win but riot anyway).

I think no, because Musk is too busy to accept another job (and would tell Trump this), or if he did accept another job it would be some vague czar position rather than falling along cabinet lines.

An even better question: if Musk did get a high-level position, would it go well? I would bet 30-70 no: he’s done some amazing things with his businesses, but the success rate for businesspeople trying to transfer their skills to government is low. Here I’m most moved by the example of Herbert Hoover, who started out as the Elon Musk of his day, did a good job as Commerce Secretary, but wasn’t able to cut it as President - he was too much of a move-fast-and-break-things autocratic CEO to handle a situation where he had to make compromises, appease stakeholders, and slowly build coalitions. You could imagine Trump thinking really hard about how to carve out a role that played to Elon’s strengths while shielding him from his weaknesses, but - no, sorry, I did a bad job starting this sentence, you can’t actually imagine Trump doing that.

Comparing this to the main election market, it looks like forecasters think there’s about a 75% chance that Trump nominates RFK if he wins.

Notice this is November 6, the day after election day.

This awkwardly combines two questions: how much will we know when, and how paranoid will CNN be about premature declarations? I would be happier with a question about when prediction markets themselves will go above 90%, but that might be loaded too - last election, PredictIt shares in Trump took ludicrously long to go down to zero, because shareholders kept holding out hope that his election challenges would succeed.

London Breed is the Mayor of San Francisco. My understanding is that she is relatively moderate for a San Francisco politician - YIMBY, pro-sheltering-the-homeless, and less-than-infinitely-soft-on-crime. San Francisco is still terrible, but has gotten slightly better during her term, and my impression is that the small magnitude of the improvement is more because it’s too much for any one person to solve in a few years than because of any flaw in Mayor Breed’s policies. Still, voters are understandably upset and her chances are slim. A highly deranged Kalshi market favors Daniel Lurie, an extreme outsider who is the heir to the Levi Strauss fortune but otherwise has no experience with anything; his pitch is “Vote for me, I have never been even slightly involved in SF politics before”, and it seems to resonate.

Thankfully, San Francisco has ranked-choice voting, so voters will be able to freely choose their favorite among this diverse group of candidates. I am not a praying man, but I would like to request that Aaron Peskin, the worst NIMBY in San Francisco, not get elected.

Mantic Links:

1: The Super Model is a good new prediction market Substack which includes an aggregator (I’m against it - I think Polymarket etc add negative signal when you already have Metaculus and Nate Silver), some good theoretical work, and good discussions of sudden betting market shifts.

2: And Rajiv Sethi’s Imperfect Information is another good prediction market Substack that’s appeared recently. I relied on their excellent analysis for some of my discussion of the big Polymarket bet.

3: Manifold Markets is hosting an election night party (or mourning vigil, depending) in Berkeley, go here for details.

Judgment Day, Part 2:

When every ballot has been cast

And texts from PACs have stopped at last

When dunks are done and screeds are said

And blackness covers blue and red

When eighteen months of fear have been

Compressed into a single screen

A single screen with two thin lines

That rise and fall to doubtful signs

When moonlight shimmers on the walls

And Polymarket lags and stalls

And groans with strain as shares fly fast

Till one thin line shoots up at last

Hold firm your hand upon the helm

Let joy nor sorrow overwhelm

Stay hydrated, eat food, and keep

Your friends nearby, and maybe sleep

Tomorrow is another day

And '28's not far away

The world will make it through okay

But still, it couldn't hurt to pray:

"Judge of the Nations, spare us yet

Lest we forget - lest we forget!"